Bitcoin in 2024

Last November, I wrote "Bitcoin fixes this?" to explain my bitcoin bull thesis. It's been roughly one year since I went down the bitcoin rabbit hole, so lets check back in with my predictions and list 3 reasons to be bullish heading into 2024 and beyond.

Rate cuts are incoming

As I mentioned in "Bitcoin fixes this?", our economy is now dependent on near-zero interest rates. As the Fed has hiked rates from <0.1% up to 5.3% over the last two years, they exposed the systemic instability in the banking system (2023 Regional Banking Crisis) and exacerbated the US federal debt spiral. Federal government interest payments are nearing $1 trillion annually, and have passed defense spending to become the 2nd most expensive program on the budget behind social security.

It is not sustainable for the Treasury to keep rolling over their debt at 5% interest rates, and the Treasury and Fed know it. I wasn't surprised when the Fed indicated rate cuts are coming in 2024. The Treasury is shifting into longer term bonds, signaling that they believe that interest rates have topped out. Lower rates lead to more credit creation, dollar debasement, and inflation, all the more reason to store your savings in a scarce asset like bitcoin. To read more on the debt spiral I recommend checking out James Lavish's twitter

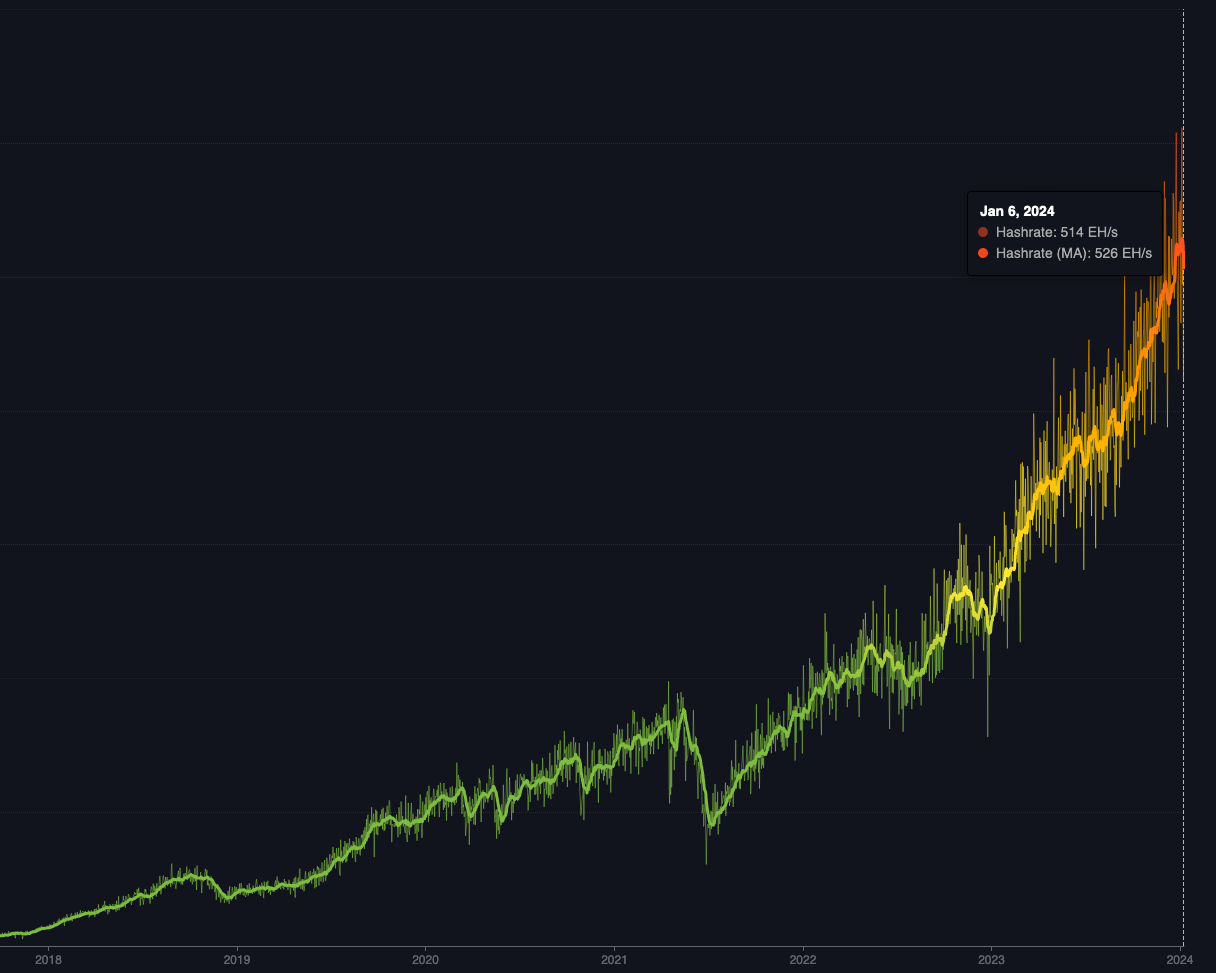

The network is as strong as ever

Mining hashrate represents the total amount of energy and computational power securing the Bitcoin network. More mining machines increase the decentralization of the network and make it harder for malicious actors to carry out attacks such as double spending or 51% attacks. The recent all time highs in hashrate give me the confidence to say that bitcoin is the most secure and robust computer network ever built.

From a user experience perspective, bitcoin has also come a long way. There is healthy competition in the market for bitcoin wallets and exchanges, and the ecosystem of Bitcoin-only companies has blossomed over the last 4 years. Bitcoin is ready for a tidal wave of adoption.

ETFs on the cusp of approval

At the time of writing, the SEC is expected to announce approval of many spot bitcoin ETFs within days. When these products go live, investors will have access to spot bitcoin right alongside stocks and bonds through their brokerage. While its highly recommended to buy real bitcoin and practice self custody, many large pools of capital are limited to buying regulated securities. Through the ETF, these pensions, hedge funds, etc, will have easy access to spot bitcoin for the first time.

I won't predict what short term price fluctuations will be caused by ETF approval, but over a longer time horizon ETFs will open the door to more institutional adoption.

We're still early.

Comments

Sign in to leave a comment.