“Bitcoin fixes this” is a common saying among Bitcoin maximalists. It arises from the notion that many of the socioeconomic challenges we face to today (massive wealth inequality in particular) are rooted in the fundamentals of our debt-based monetary system, and that bitcoin offers an ethical and fair alternative.

Inflation

In the mid 1900s, western economies de-pegged their currencies from gold. Since then, all fiat currencies are now backed by increasing mountains of government debt and have trended toward zero. The devaluation of a currency is experienced as inflation.

But why has the dollar lost so much of its purchasing power?

Debt

Economic growth over the last century has been financed by debt. Over time, global corporate and government debt has dramatically increased as a percentage of GDP. Sustained global economic growth has required increasing amounts of debt.

The U.S. is caught in a debt spiral, where the treasury has to issue more debt to pay off its existing debt and pay for government operations.

The debt mountain is now so large, that small interest rate increases cause federal interest payment expenses to skyrocket. When central banks raises interest rates to "fight" inflation, they know it can only be for a limited time, because governments can not sustainable fund their operations with high interest rate debt.

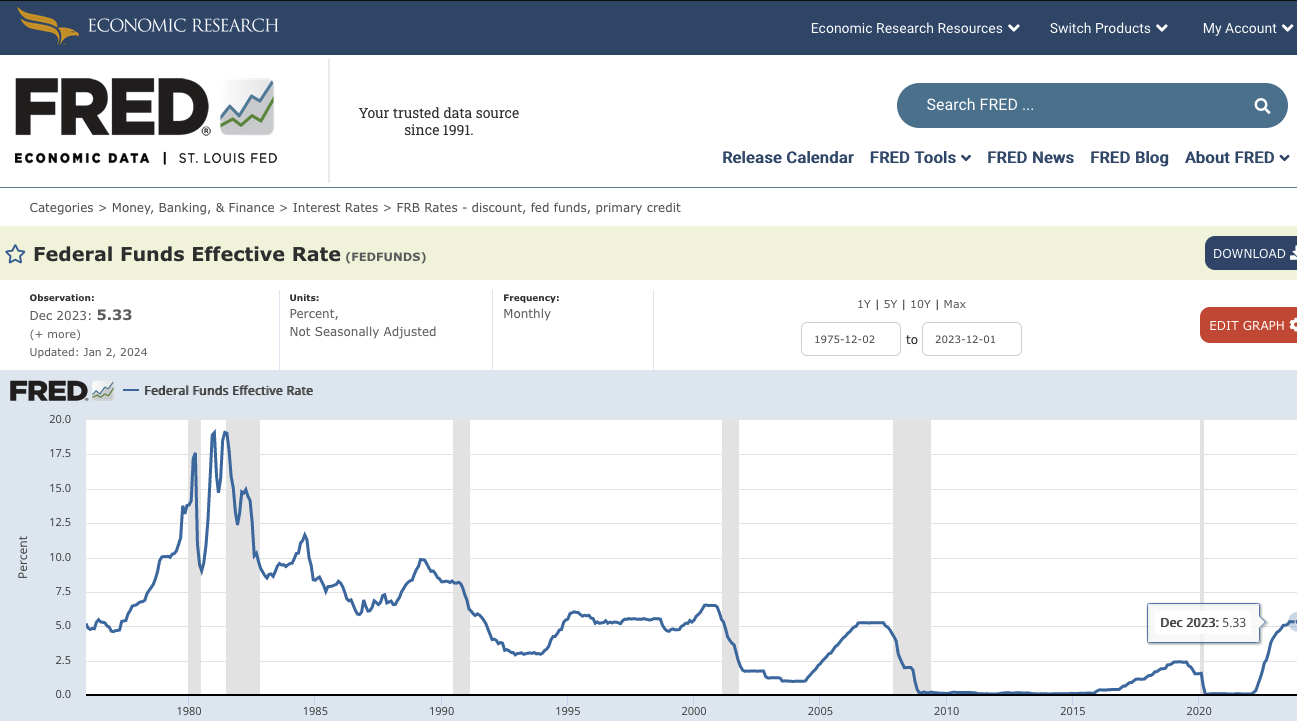

Since 1981, Every time the Fed has raised rates it has held for a period and then cut to lower lows. After the GFC we've become addicted to 0% interest rates. We'll see how the current hiking cycle turns out...

The US government can not default (i.e. fall short/behind on payments). The global economy is built on the trustworthiness of US government bonds. If the US stopped paying its debts, the entire global banking system would collapse and billions of people would lose their collective trillions of dollars in savings. And the only way we can keep paying our bills and debts is by taking on extremely low (zero) interest rate debt.

USD monetary units are created when the government spends the cash it "earns" from debt issuance, and the dollar is thus debased. A detox from debt is not politically feasible for the US establishment: they will not get elected if they vote to cut programs (yes, even republicans vote to maintain or increase spending). Debt ceilings are raised, interest rates are cut, and more debt is issued thus inflating the money supply and devaluing the currency.

Assets to store value

Since our money doesn’t retain value, individuals and organizations use assets to store value. Some of the most popular asset classes are real estate, gold, and securities (stocks and bonds), but each asset class has its risks and limitations.

Physical assets are not efficient. Real estate, a common value storage asset, comes with many costs such as maintenance, insurance, and tax. In addition to risk and cost, physical assets are constrained by the physical world - They are exceedingly difficult to transport and transform. Beyond the direct costs, physical assets require a display of force to protect, and in turn, these property protection forces (police) can be wielded by the establishment to oppress minorities and maintain power.

In addition to physical assets, many individuals utilize securities as a store of value. Securities, namely stocks and bonds, are commonplace in retirement and pension funds globally. But securities are often riskier than property - their value is dependent on the decision making of the issuer. If I buy $100 of company X stock, I have to hope the CEO of company X avoids any number of ways to destroy the value of the company.

Wealthy westerners abate the inherent risk of these assets with diversification. A "well balanced portfolio" protects investors from a downturn in any one market segment. However, this protection is dependent on access to the financial system. Working class individuals do not always have the time, energy, or capital required to invest in ways that actually retain value. A subsistence farmer in the global south likely can't open a Vanguard account, but they can buy, save, and spend bitcoin.

Technology is deflationary, Inflation is theft

Deflation is when currency’s purchasing power increases, meaning money gets you more for less. Technology is inherently deflationary. Consider the cost of all the products replaced by an iPhone (camera, calendar, print media, voice recorder, flashlight, etc). A $10/month music streaming subscription is much cheaper than paying $20 per individual vinyl record. With the explosion of productivity gains offered by technology, we should’ve seen a mass deflationary effect in the economy. Working hours should be lower and purchasing power should be increasing, but why hasn’t it?

Consider the fiat monetary system. If my money is losing value, where is that value going? Primarily, its to the corporations, governments, and wealthy individuals who take on massive amounts of cheap debt to purchase property. As time passes and inflation marches on, that debt is becomes easier to pay back while the asset appreciates value.

Take the example of a landlord ⟷ renter relationship. The landlord purchased a property with low interest debt, for which the fixed monthly mortgage payment is effectively cheaper every year due to inflation. However, that landlord also increases the rent he charges every year because inflation is causing the price of all housing to increase. Thus the renter has to keep paying more and more, while the landlord makes more and more in profit. Increasing rent further reduces the ability of the renter to save money, since a larger percentage of their paycheck must go to rent.

This system has crippled the ability of the lower and middle classes to save. Their expenses increase disproportional to their earnings, and any money they can save is inevitably devalued by inflation. Furthermore, inflation actively promotes rent seeking, as wealthy individuals know they can't simply hold onto their cash, they must turn it into an income stream.

Inflation is a mechanism of control that benefits the wealthy at the expense of the poor.

Bitcoin fixes this

Our fiat-based global economy is addicted to inflation, which creates massive inefficiencies and wealth inequality. Bitcoin solves these issues by providing a store of value as digital energy in an ethical, permissionless, decentralized digital asset available to anyone with an internet connection (~60% of the world’s population, and fast increasing).

Lets explore the qualities of Bitcoin that differentiate it from fiat:

An Ethical Fixed Supply

Time and time again, governments find reasons to print money, devaluing existing cash (inflation). There only will ever be 21 Million Bitcoin; debasement is impossible. No central authority can devalue the existing coins by creating more in the name of corporate/government bailouts. No software team or VC owns a sizable "pre-mine" position that they can dump on retail investors.

No trusted 3rd parties

The US dollar is centralized, with a government entity gatekeeping market participation. To participate in a transaction of USD via the internet, you must be in the good graces of a corporation which facilitates such transactions. This prevents unbanked people in developing nations from participating in the global economy.

Bitcoin is decentralized, where no single entity can limit access. Anyone can transact. Bitcoin is a public protocol which gives access to billions of individuals who are excluded from the USD system. Via satellite internet (i.e. Starlink) you could download the whole blockchain (~600gb), run a node, and mine from anywhere on Earth.

Digital, not physical

Bitcoin empowers individuals through property rights. For the first time in history, no central authority is needed to permit and protect ownership. Anyone can generate a private key to send/receive funds. With a mnemonic seed phrase, individuals can even store their wallet completely in their head (although its recommend to use a hardware signing device for security).

Compare BTC to:

- Real Estate: I can’t move a house, and transacting a house can take months. I could also lose a house to external forces such as natural disaster or civil forfeiture.

- Gold: To move gold (or paper money representing gold), I must be able to physically bring it with me, and any person with more physical power (i.e. weaponry) could take it from me.

With bitcoin, my property is accessible from anywhere in the world. I think this is particularly compelling in the case of providing an exit to people trapped by oppressive regimes.

An evolution, not revolution

Anarcho-capitalist bitcoiners would argue that dissolution of the government is the only path to Bitcoin adoption. However, I believe this is counter to the mechanics of biological evolution. It isn’t realistic to think that one day we could wake up and erase world governments. Instead, I believe the idea will slowly permeate society, and some will not recognize the change until it has already happened.

Over the last 10 years, Bitcoin has gradually gained momentum. In the beginning, Bitcoin had no monetary value - you couldn’t use it to buy goods or services. That all changed on pizza day in 2010, when an early adopter bought two pizzas for 10,000 BTC. This was the first time Bitcoin was used to buy a real world good. Over time, the Bitcoin community grew, and real institutional adoption began in 2020 when public corporations started adding Bitcoin to their balance sheet.

Functions of money

- Medium of exchange

- Store of value

Bitcoin today is not ready to be used as the world’s medium of change. We need to build layers to the ecosystem: protocols, companies, apps, etc. The Bitcoin protocol is a foundation, and we are still in the early stages of building an entire economy on top of that foundation. Applications built on bitcoin will drive institutional adoption, which will drive investment, which will create new tech and applications.

But as a store of value, bitcoin is second to none. It is the scarcest asset on Earth. We will continue to see Bitcoin be the best store of value against the USD as all fiat currencies continue to inflate. As more individuals, organizations, and governments come to grasp the reality of Bitcoin as digital property, more more will invest. Over time, all other assets will devalue against Bitcoin, strengthening Bitcoin’s position as the best way to store economic energy.

Find out more

This article is a synthesis of the bitcoin bull case from many bitcoiners, who all have their own articles and podcasts explaining in much more depth than I do here. Check out the links below:

Comments

Sign in to leave a comment.